LoanComp app for iPhone and iPad

Developer: Mountain Lake Technology, Inc.

First release : 20 Jul 2016

App size: 10.71 Mb

With interest rates at or near all time lows, there has never been a better time to consider re-financing your mortgage or other high cost items that are financed (ie. cars, boats, other debt). Also, since rates can only go up at this point, banks are likely to offer enticing rates on Adjustable Rate Mortgages (ARMs) with the expectation of locking you into higher rates in the future. Evaluating which of the many options available to you are best (fixed vs. adjustable, higher down payment to get lower interest rate) is dependent on several keys factors. These factors include:

- The length of time you will have the mortgage or other loan.

- The length of time the interest rate is locked (ie. 3, 5 or 7 years).

- After the lock, how much can the interest rate increase or decrease annually or over the life of the loan.

- The actual rate of change of the index upon which your mortgage rate will adjust.

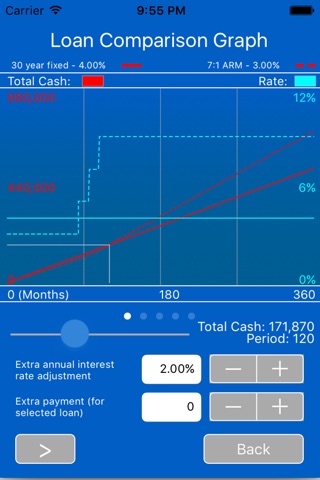

LoanComp allows you to quickly enter the fixed parameters of your loan then put in your estimate as to the length of the loan and your expectations as to how interest rates will likely change. LoanComp will quickly calculate which loan(s) are most favorable in terms of lowest payment, least amount of overall cash expended and greatest amount of equity built up (or debt reduction). Additionally, you can then quickly adjust your estimated parameters to determine your best and worst case scenarios. For example, you estimate you will be in your home for 5 years but what happens if you end up staying an additional 3 years or you estimate your interest rate on your variable loan will go up 1/2 a percent annually after the lock expires but what if it goes up by 2 percent annually. LoanComp can quickly show you these results in both tabular and graphic form. Using typical spreadsheet programs to correctly map out amortization schedules for adjustable rate loans can take hours per scenario.